The Anatomy of Ponzi Schemes

Ponzi schemes have gained notoriety within the financial realm due to their enticing allure of substantial returns and rapid profits. Originating from the infamous strategies employed by Charles Ponzi in the early 20th century, these fraudulent schemes operate by distributing profits to initial investors through the funds contributed by subsequent participants.

What is Ponzi Schemes?

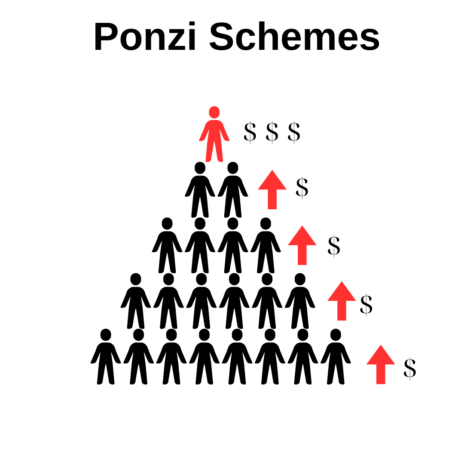

A Ponzi scheme operates on the “rob-Peter-to-pay-Paul” principle. Initially, the schemer uses their own money to pay returns to early stage investors, creating an illusion of a profitable, legitimate business. Later investors’ contributions are then used to pay earlier investors, keeping the illusion alive. However, this structure is unsustainable in the long run, as the returns rely on an ever-increasing flow of money from new investors.

Key Characteristics of Ponzi Schemes

| Characteristic | Description |

|---|---|

| Promise of high returns with little risk | These schemes often allure investors with the promise of unusually high returns. |

| Over-reliance on new investors | The scheme relies on a constant flow of new investments to continue. |

| Lack of legitimate underlying investment operation | There are no genuine earnings or business operations in a Ponzi scheme. |

| Payment difficulties | When new investments slow or stop, the scheme collapses, as there are no longer sufficient funds to pay promised returns. |

Wha is the Difference from Other Frauds?

It’s important to differentiate Ponzi schemes from other types of fraud. A significant distinction lies in the mechanism of the fraud. For example, in a pyramid scheme – another type of investment fraud – participants earn money by recruiting new members into the scheme, not from profits of a supposedly legitimate business operation.

What is The Impact of Ponzi Schemes?

The harmful impacts of Ponzi schemes can be enormous, causing financial ruin for individuals and shaking confidence in financial markets. Notable examples include the Bernie Madoff scandal in 2008, who defrauded investors of an estimated $65 billion, and Allen Stanford’s scheme that cheated investors of over $7 billion.

Examples of Biggest Ponzi Schemes in History

| Individual | Amount Defrauded | Year |

|---|---|---|

| Bernie Madoff | $65 billion | 2008 |

| Allen Stanford | $7 billion | 2009 |

Conclusion

Ponzi schemes represent a malicious form of fraud that exploit trust and desire for financial gain. They promise high returns with little risk, and pay these returns from new investors’ funds, rather than genuine business profits. Their inevitable collapse results in significant losses for most participants, particularly those who join later in the scheme’s operation. The catastrophic impact of such schemes underscores the importance of due diligence in investing and the necessity of regulatory oversight in the financial markets.

FAQS

A Ponzi scheme is a type of financial fraud where returns are paid to early investors from the investments of later participants, rather than from profit earned by the individual or organization running the operation.

Quizlet, an online learning platform, defines a Ponzi scheme as a fraudulent investing scam promising high rates of return with little risk to investors. The scheme leads victims to believe that profits are coming from legitimate business activity, but in reality, they are coming from payments made by new victims.

Fraud is a broad term referring to any deceptive practice used to secure unfair or unlawful gain. A Ponzi scheme is a specific type of fraud involving an investment scam where funds from new investors are used to pay returns to earlier investors.

The most infamous Ponzi scheme was orchestrated by Bernie Madoff, who was convicted for defrauding investors of billions of dollars. Charles Ponzi, for whom the scheme is named, swindled investors by promising 50% returns on investments in international reply coupons.